Authors:

(1) Aarav Patel, Amity Regional High School – email: [email protected];

(2) Peter Gloor, Center for Collective Intelligence, Massachusetts Institute of Technology and Corresponding author – email: [email protected].

Table of Links

- Abstract and Introduction

- Related Works

- Purpose

- Methods

- Results

- Discussion

- Conclusion and Bibliography

Abstract

Environmental Social Governance (ESG) is a widely used metric that measures the sustainability of a company’s practices. Currently, ESG is determined using self-reported corporate filings, which allows companies to portray themselves in an artificially positive light. As a result, ESG evaluation is subjective and inconsistent across raters, giving executives mixed signals on what to improve. This project aims to create a data-driven ESG evaluation system that can provide better guidance and more systemized scores by incorporating social sentiment. Social sentiment allows for more balanced perspectives which directly highlight public opinion, helping companies create more focused and impactful initiatives. To build this, Python web scrapers were developed to collect data from Wikipedia, Twitter, LinkedIn, and Google News for the S&P 500 companies. Data was then cleaned and passed through NLP algorithms to obtain sentiment scores for ESG subcategories. Using these features, machine-learning algorithms were trained and calibrated to S&P Global ESG Ratings to test their predictive capabilities. The Random-Forest model was the strongest model with a mean absolute error of 13.4% and a correlation of 26.1% (p-value 0.0372), showing encouraging results. Overall, measuring ESG social sentiment across sub-categories can help executives focus efforts on areas people care about most. Furthermore, this data-driven methodology can provide ratings for companies without coverage, allowing more socially responsible firms to thrive.

Keywords: Environmental Social Governance, Machine Learning, Social Network Analytics, Corporate Social Responsibility, Natural Language Processing, Sustainability, Online Social Media

1. Introduction

Many feel companies need to place more emphasis on social responsibility. For instance, 100 companies have been responsible for 71% of global greenhouse gas emissions since 1998 (Carbon Majors Database[1]). Many business leaders have publicly stated that they are on board with incorporating sustainability measures. In 2016, a UN survey found that 78% of CEO respondents believed corporate efforts should contribute to the UN Standard Development Goals, which are goals adopted by the United Nations as a universal call to action to end poverty and protect the planet (UN, 2016). However, while many executives pledged greater focus on these areas of concern, only a few took noticeable tangible action. In a more recent 2019 UN survey, only ~20% of responding CEOs felt that businesses were making a difference in the worldwide sustainability agenda (UN, 2019). These surveys highlight a disconnect between sustainability goals and sustainability actions. They also highlight inefficiencies in current executive actions since many feel they are not making enough progress toward social responsibility.

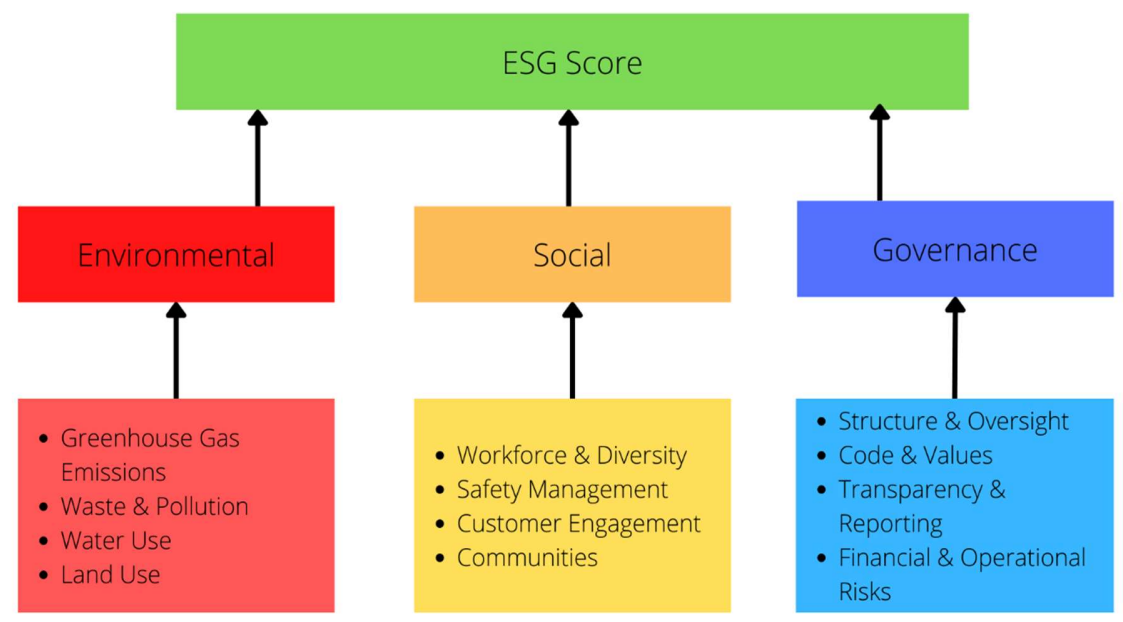

ESG, or Environmental Social Governance, is a commonly used metric that determines the sustainability and societal impact of a company’s practices. ESG raters such as MSCI (Morgan Stanley Capital International), S&P Global, and FTSE (Financial Times Stock Exchange) do this by measuring sub-categories such as pollution, diversity, human rights, community impact, etc. (figure 1). Measuring these areas of concern are necessary since they encourage companies to rectify bad practices. This is because ESG ratings can influence factors such as investor capital, public perception, credit ratings, etc. Furthermore, ESG ratings can provide companies with specific information on which key areas to improve, which can help better guide their initiatives.

At the moment, ESG is assessed by rating agencies using self-reporting company filings. As a result, companies can often portray themselves in an artificially positive light. These biased reports have led to subjective and inconsistent analysis between different ESG rating organizations, despite them seeking to measure the same thing (Kotsanonis et al., 2019). For instance, the correlation among six prominent ESG rating agencies is 0.54; in comparison, mainstream credit ratings have a stronger correlation of 0.99 (Berg et al., 2019). As a result, many feel there is a disconnect between ESG ratings and a company’s true social responsibility. This highlights how subjective assessment and limited data transparency from self-reporting can create inconsistent ratings.

Having more consistent and accurate ESG evaluation is important. Divergence and imprecision in ESG ratings hamper motivation for companies to improve since they give executives mixed signals on what to change (Stackpole, 2021). As a result, it becomes difficult to create better-targeted sustainability initiatives. Furthermore, self-reporting allows companies with more resources to portray themselves better. This is why there is a significant positive correlation between a company’s size, available resources, and ESG score (Drempetic et al., 2019). These issues ultimately defeat the purpose of ESG by failing to motivate companies toward sustainable practices. This raises the need for a more holistic and systemized approach to ESG evaluation that can more precisely measure a company’s social responsibility. By establishing a more representative ground truth, it can better guide company initiatives toward social responsibility, thus increasing the impact of ESG.

This paper is available on arxiv under CC BY-NC-ND 4.0 DEED license.