Table of Links

CHAPTER 1: INTRODUCTION

CHAPTER 2: BACKGROUND

2.1 Blockchains & smart contracts

2.2 Transaction prioritization norms

2.3 Transaction prioritization and contention transparency

2.5 Blockchain Scalability with Layer 2.0 Solutions

CHAPTER 3. TRANSACTION PRIORITIZATION NORMS

CHAPTER 4. TRANSACTION PRIORITIZATION AND CONTENTION TRANSPARENCY

-

Transaction Prioritization and Contention Transparency

4.2 On contention transparency

CHAPTER 5. DECENTRALIZED GOVERNANCE

CHAPTER 6. RELATED WORK

6.1 Transaction prioritization norms

6.2 Transaction prioritization and contention transparency

CHAPTER 7. DISCUSSION, LIMITATIONS & FUTURE WORK

7.3 Voting power distribution to amend smart contracts

Appendices

APPENDIX A: Additional Analysis of Transactions Prioritization Norms

APPENDIX B: Additional analysis of transactions prioritization and contention transparency

APPENDIX C: Additional Analysis of Distribution of Voting Power

5.2 Attacks on governance

A potential issue in the governance of blockchain networks is the concentration of governance tokens in the hands of a few participants, which can pose a threat to the protocol (Mike Dalton, 2022). This issue manifested in Balancer (Balancer.fi, 2023), a decentralized exchange (DEX) running on top of Ethereum, where a user with large amount of governance tokens voted for decisions that were beneficial for the user but detrimental for the protocol (Haig, 2022). When a minority holds a large portion of the tokens, decision-making power can become centralized, which conflicts with the goal of decentralization of governance protocols

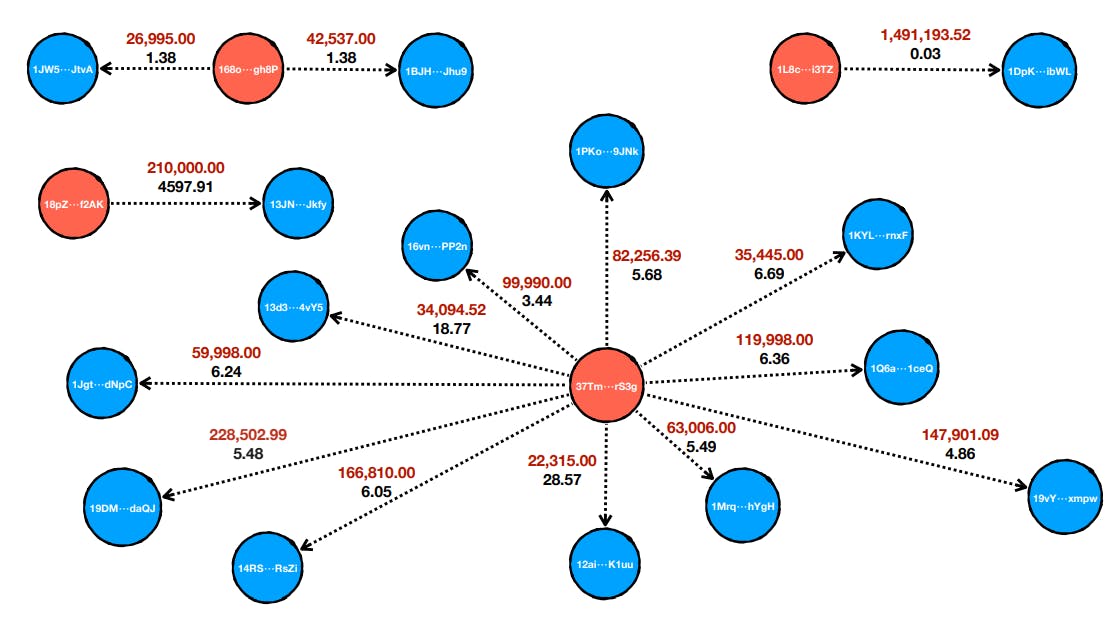

Yet another issue concerns many centralized exchanges that hold their users’ tokens; they could potentially use these tokens for voting without their users’ knowledge, compromising the integrity of the voting process (Francisco Rodrigues, 2022; Sam Kessler, 2022). Alameda Research, a former cryptocurrency trading firm, which was affiliated with FTX, for example, voted on 8 proposals and even initiated three proposals (#13, #14, and #16) on Compound (Research, 2020a,b,c). Eventually, one of the proposals was executed. Their goal was to raise the collateral of WBTC from 0% to 40%, which allowed WBTC to be utilized for borrowing other assets (Zack Voell and William Foxley, 2020a). This change may have been beneficial to Alameda Research as they were one of the biggest WBTC minters and held highly leveraged positions (i.e., borrowed money to invest even more) (Jeff Kauflin and Emily Mason, 2022; Zack Voell and William Foxley, 2020b). To alleviate these concerns, centralized exchanges typically promise that they will not use their users’ tokens to vote on their behalf (Shaurya Malwa, 2022). While there is no guarantee that they will keep their promise, we can monitor their public wallet addresses to check if the exchange has delegated these governance tokens to another address, or whether they used the tokens for voting while they were stored on that exchange.

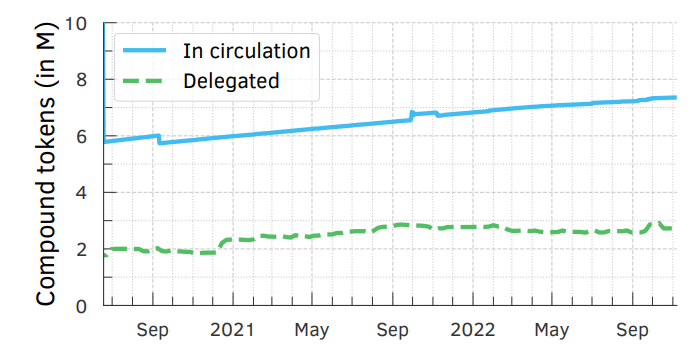

Governance protocols intend to eliminate (or at least minimize) centralized decisionmaking in blockchains. Their effectiveness in achieving that goal can, however, be compromised depending on how the tokens (i.e., voting power) are distributed. This thesis evaluates whether governance protocols uphold their promise of decentralized governance of smart contracts, and, if they do not, investigates exactly how they renege on that promise.

Author:

(1) Johnnatan Messias Peixoto Afonso

This paper is