Table of Links

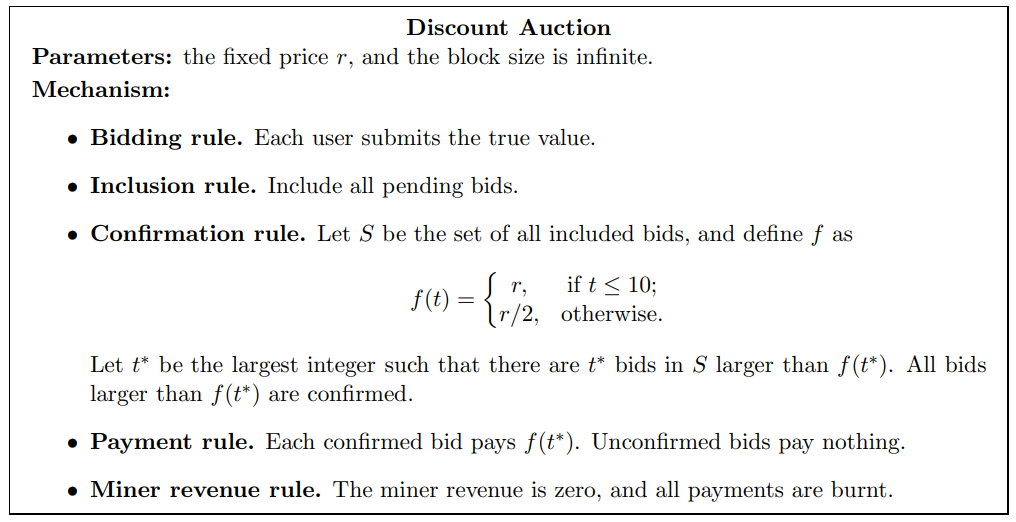

1.2 TFM Incentive-Compatibility Notions: A Cheat Sheet

-

Definitions

-

Warmup: Impossibility of UIC + MIC + Global SCP for Deterministic Mechanisms

-

Impossibility of UIC + MIC + Global SCP for Randomized Mechanisms and 5.1 Proof Roadmap

-

Feasibility and Impossibility of UIC + MIC + OCA-Proof

6.1 A Non-Truthful Mechanism with UIC + MIC + OCA-Proof

6.2 Impossibility of UIC + MIC + OCA-Proof for Truthful Mechanisms

-

How to Circumvent the Impossibilities and 7.1 Allowing the Globally Optimal Strategy to Coordinate

7.2 Allowing the Globally Optimal Strategy to Output Multiple Bids

-

Static Revelation Principle for Transaction Fee Mechanisms

8.1 Static Revelation Principle: Bidding Rules That Output Single Bid

8.2 Static Revelation Principle: Allowing Bidding Rules that Output Multiple Bids

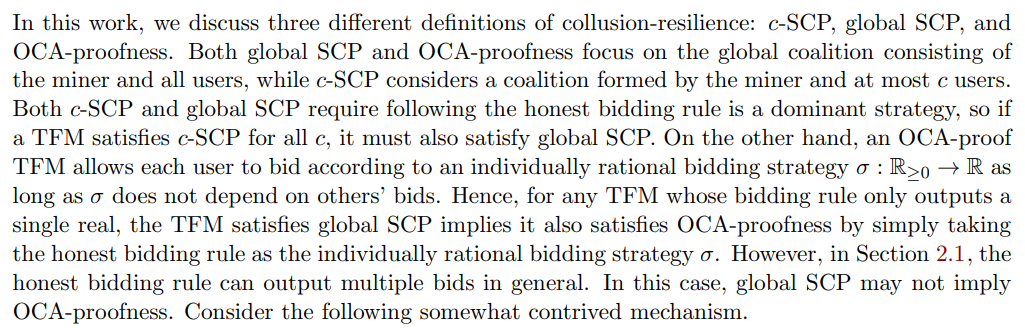

A. Comparison of Collusion-Resilience Notions

A Comparison of Collusion-Resilience Notions

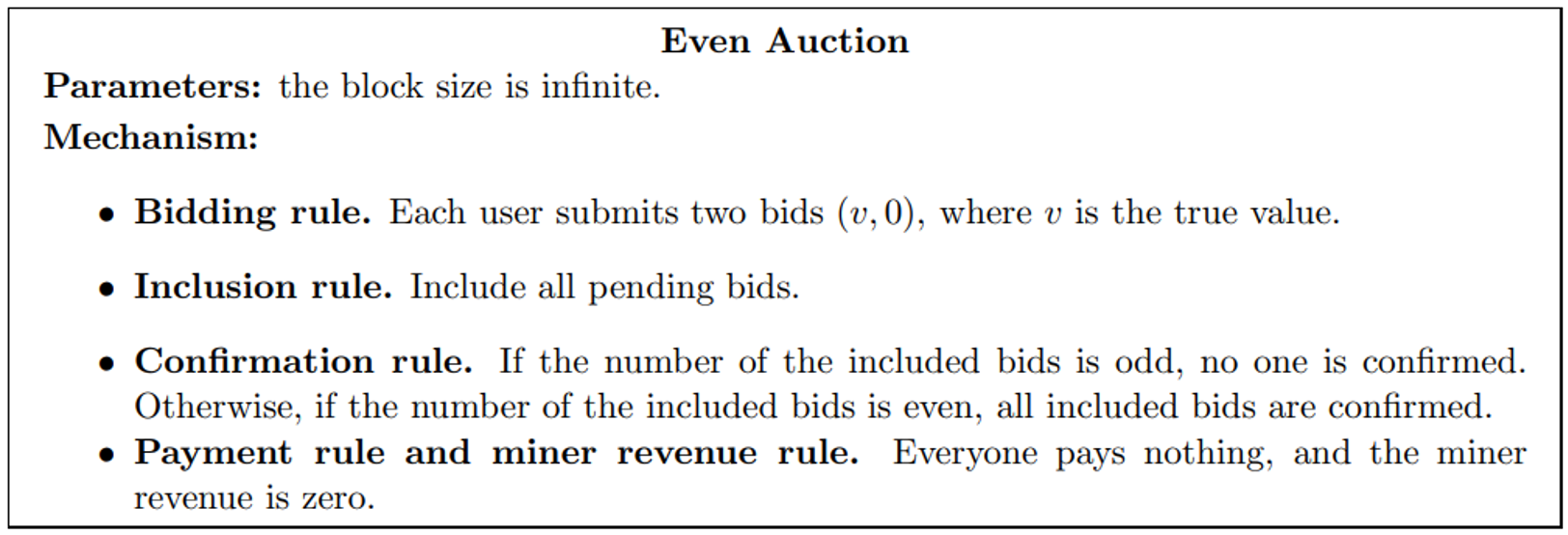

Lemma A.1. The even auction above satisfies global SCP but not OCA-proofness.

Notice that whether the individually rational bidding strategy σ outputs a single bid or multiple bids is important. If we require σ to only output a single real as we defined in Definition 6, there is no non-trivial TFM that can satisfy UIC, MIC, and OCA-proofness as we proved in Theorem 6.9. However, if we allow σ to output multiple bids, we obtain a feasibility in Section 7.2.

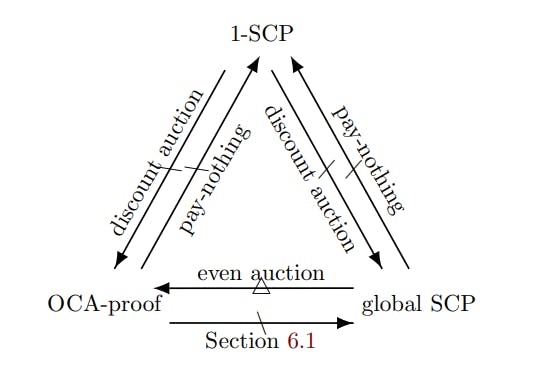

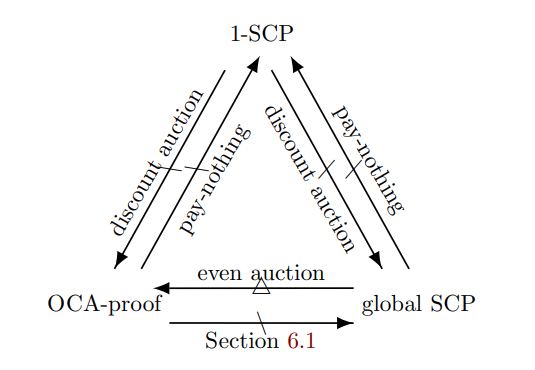

When we analyze whether a TFM satisfies c-SCP for some c, 1-SCP is the weakest requirement since c′ -SCP always implies c-SCP for any c′ > c by definition. Interestingly, even so, 1-SCP is incomparable with global SCP and OCA-proofness. The relations between 1-SCP, global SCP, and OCA-proofness is depicted in Figure 1.

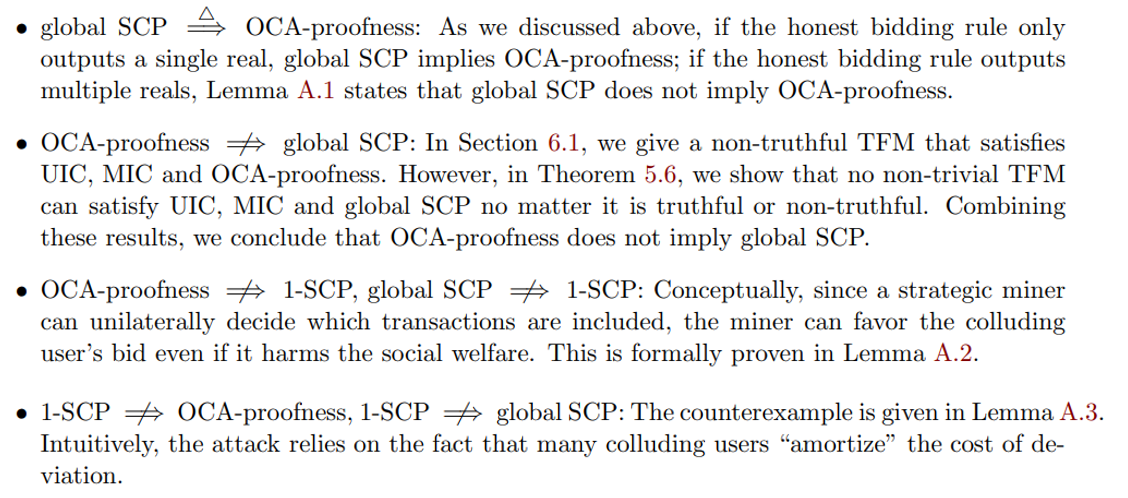

We explain Figure 1 in more detail below:

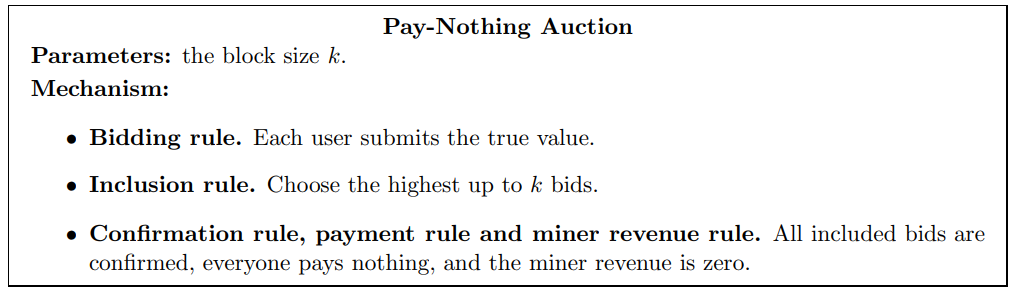

Below, we introduce the (somewhat contrived) auctions for constructing the counterexamples.

Lemma A.2. The pay-nothing auction above satisfies global SCP and OCA-proofness. However, it does not satisfy 1-SCP.

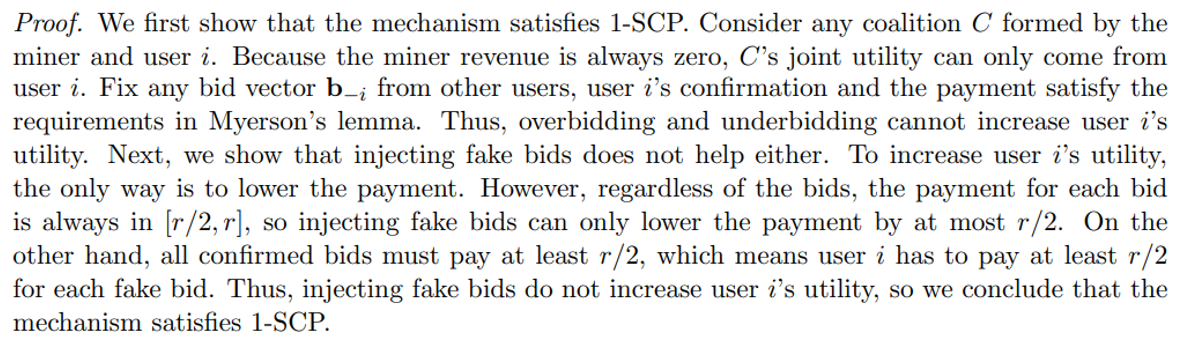

Lemma A.3. The discount auction above satisfies 1-SCP. However, it does not satisfy global SCP or OCA-proofness.

Now, we show that the mechanism does not satisfy OCA-proofness. Imagine a scenario where there are 10 users each with the true value r. Without injecting any fake bid, the lowest possible payment for each user is f(10) = r, so the social welfare is at most 0. However, if the global coalition inject one fake bid r, everyone’s payment will further lower to f(11) = r/2. In this case, the social welfare becomes 10r − 11r/2 = 9r/2 > 0. Thus, the mechanism does not satisfy OCA-proofness.

The mechanism does not satisfy global SCP either since the bidding rule only outputs a single real. If the mechanism satisfied global SCP, the global coalition could pick the suggested bidding rule as the individually rational bidding strategy σ to maximize the social welfare. Given that the mechanism does not satisfy OCA-proofness, it cannot satisfy global SCP either.

References

[ACH11] Gilad Asharov, Ran Canetti, and Carmit Hazay. Towards a game theoretic view of secure computation. In Eurocrypt, 2011.

[ADGH06] Ittai Abraham, Danny Dolev, Rica Gonen, and Joseph Halpern. Distributed computing meets game theory: Robust mechanisms for rational secret sharing and multiparty computation. In PODC, 2006.

[AL11] Gilad Asharov and Yehuda Lindell. Utility dependence in correct and fair rational secret sharing. Journal of Cryptology, 24(1), 2011.

[BCD+] Vitalik Buterin, Eric Conner, Rick Dudley, Matthew Slipper, and Ian Norden. Ethereum improvement proposal 1559: Fee market change for eth 1.0 chain. https://github.com/ethereum/EIPs/blob/master/EIPS/eip-1559.md.

[BEOS19] Soumya Basu, David A. Easley, Maureen O’Hara, and Emin G¨un Sirer. Towards a functional fee market for cryptocurrencies. CoRR, abs/1901.06830, 2019.

[BGR23] Maryam Bahrani, Pranav Garimidi, and Tim Roughgarden. Transaction fee mechanism design with active block producers. arXiv preprint arXiv:2307.01686, 2023.

[CCWS21] Kai-Min Chung, T-H. Hubert Chan, Ting Wen, and Elaine Shi. Game-theoretic fairness meets multi-party protocols: The case of leader election. In CRYPTO. Springer-Verlag, 2021.

[CGL+18] Kai-Min Chung, Yue Guo, Wei-Kai Lin, Rafael Pass, and Elaine Shi. Game theoretic notions of fairness in multi-party coin toss. In TCC, volume 11239, pages 563–596, 2018.

[CMW23] Davide Crapis, Ciamac C Moallemi, and Shouqiao Wang. Optimal dynamic fees for blockchain resources. arXiv preprint arXiv:2309.12735, 2023.

[CS23] Hao Chung and Elaine Shi. Foundations of transaction fee mechanism design. In Proceedings of the 2023 Annual ACM-SIAM Symposium on Discrete Algorithms (SODA), pages 3856–3899. SIAM, 2023.

[DR07] Yevgeniy Dodis and Tal Rabin. Cryptography and game theory. In AGT, 2007.

[EFW22] Meryem Essaidi, Matheus V. X. Ferreira, and S. Matthew Weinberg. Credible, strategyproof, optimal, and bounded expected-round single-item auctions for all distributions. In Mark Braverman, editor, 13th Innovations in Theoretical Computer Science Conference, ITCS 2022, January 31 - February 3, 2022, Berkeley, CA, USA, volume 215 of LIPIcs, pages 66:1–66:19, 2022.

[FMPS21] Matheus V. X. Ferreira, Daniel J. Moroz, David C. Parkes, and Mitchell Stern. Dynamic posted-price mechanisms for the blockchain transaction-fee market. CoRR, abs/2103.14144, 2021.

[FW20] Matheus V. X. Ferreira and S. Matthew Weinberg. Credible, truthful, and two-round (optimal) auctions via cryptographic commitments. In Peter Biro, Jason D. Hartline, Michael Ostrovsky, and Ariel D. Procaccia, editors, EC ’20: The 21st ACM Conference on Economics and Computation, Virtual Event, Hungary, July 13-17, 2020, pages 683– 712. ACM, 2020.

[GKM+13] Juan A. Garay, Jonathan Katz, Ueli Maurer, Björn Tackmann, and Vassilis Zikas. Rational protocol design: Cryptography against incentive-driven adversaries. In FOCS, 2013.

[GKTZ15] Juan Garay, Jonathan Katz, Björn Tackmann, and Vassilis Zikas. How fair is your protocol? a utility-based approach to protocol optimality. In PODC, 2015.

[GLR10] Ronen Gradwohl, Noam Livne, and Alon Rosen. Sequential rationality in cryptographic protocols. In FOCS, 2010.

[GTZ15] Juan A. Garay, Björn Tackmann, and Vassilis Zikas. Fair distributed computation of reactive functions. In DISC, volume 9363, pages 497–512, 2015.

[GY22] Yotam Gafni and Aviv Yaish. Greedy transaction fee mechanisms for (non-) myopic miners. arXiv preprint arXiv:2210.07793, 2022.

[GY24] Yotam Gafni and Aviv Yaish. Barriers to collusion-resistant transaction fee mechanisms. arXiv preprint arXiv:2402.08564, 2024.

[HT04] Joseph Halpern and Vanessa Teague. Rational secret sharing and multiparty computation. In STOC, 2004.

[Kat08] Jonathan Katz. Bridging game theory and cryptography: Recent results and future directions. In Theory of Cryptography Conference, pages 251–272. Springer, 2008.

[KKLP23] Aggelos Kiayias, Elias Koutsoupias, Philip Lazos, and Giorgos Panagiotakos. Tiered mechanisms for blockchain transaction fees. arXiv preprint arXiv:2304.06014, 2023.

[KMSW22] Ilan Komargodski, Shin’ichiro Matsuo, Elaine Shi, and Ke Wu. log*-round gametheoretically-fair leader election. In CRYPTO, 2022.

[KN08] Gillat Kol and Moni Naor. Cryptography and game theory: Designing protocols for exchanging information. In TCC, 2008.

[LRMP23] Stefanos Leonardos, Daniel Reijsbergen, Barnabe Monnot, and Georgios Piliouras. Optimality despite chaos in fee markets. In International Conference on Financial Cryptography and Data Security, pages 346–362. Springer, 2023.

[LSZ19] Ron Lavi, Or Sattath, and Aviv Zohar. Redesigning bitcoin’s fee market. In The World Wide Web Conference, WWW 2019, pages 2950–2956, 2019. [Mye81] Roger B. Myerson. Optimal auction design. Math. Oper. Res., 6(1), 1981.

[Ndi23] Abdoulaye Ndiaye. Blockchain price vs. quantity controls. Quantity Controls (July 27, 2023), 2023.

[OPRV09] Shien Jin Ong, David C. Parkes, Alon Rosen, and Salil P. Vadhan. Fairness with an honest minority and a rational majority. In TCC, 2009.

[PS17] Rafael Pass and Elaine Shi. Fruitchains: A fair blockchain. In PODC, 2017.

[Rou20] Tim Roughgarden. Transaction fee mechanism design for the Ethereum blockchain: An economic analysis of EIP-1559. Manuscript, https://timroughgarden.org/papers/eip1559.pdf, 2020.

[Rou21] Tim Roughgarden. Transaction fee mechanism design. In EC, 2021.

[SCW23] Elaine Shi, Hao Chung, and Ke Wu. What can cryptography do for decentralized mechanism design? In ITCS, volume 251 of LIPIcs, pages 97:1–97:22. Schloss Dagstuhl - Leibniz-Zentrum fur Informatik, 2023.

[TY23] Wenpin Tang and David D Yao. Transaction fee mechanism for proof-of-stake protocol. arXiv preprint arXiv:2308.13881, 2023.

[WAS22] Ke Wu, Gilad Asharov, and Elaine Shi. A complete characterization of gametheoretically fair, multi-party coin toss. In Eurocrypt, 2022.

[WSC24] Ke Wu, Elaine Shi, and Hao Chung. Maximizing Miner Revenue in Transaction Fee Mechanism Design. In Venkatesan Guruswami, editor, 15th Innovations in Theoretical Computer Science Conference (ITCS 2024), 2024.

[XFP23] Matheus Venturyne Xavier Ferreira and David C Parkes. Credible decentralized exchange design via verifiable sequencing rules. In Proceedings of the 55th Annual ACM Symposium on Theory of Computing, pages 723–736, 2023.

[Yao] Andrew Chi-Chih Yao. An Incentive Analysis of Some Bitcoin Fee Designs (Invited Talk). In ICALP 2020.

[ZCZ22] Zishuo Zhao, Xi Chen, and Yuan Zhou. Bayesian-nash-incentive-compatible mechanism for blockchain transaction fee allocation. https://arxiv.org/abs/2209.13099, 2022.

Authors:

(1) Hao Chung∗, Carnegie Mellon University ([email protected]);

(2) Tim Roughgarden†, Columbia University and a16z (crypto [email protected]);

(3) Elaine Shi∗, Carnegie Mellon University ([email protected]).

This paper is